Download Now.

by Liu-Yue (Louie) Lam, Co-Founder and CEO, Oxstone Capital Management

Studies have shown that there is a high correlation between CRE loan defaults and asset value mispricing. Therefore the key to loan loss prevention is more accurate asset valuation of the collateral. The question is how to accurately and objectively value the asset collateral in an environment where there are very few comparables. With no velocity of CRE transactions in the market and the traditional transmission system for allocating liquidity to the market place broken; CRE valuation has been incredibly difficult. In such an environment; accurate property underwriting becomes even more critical. A key component in property valuation is the cap rate. Cap rates tend to be especially effective in deriving a value estimate for stabilized income producing properties. The determination of an appropriate cap rate is very important

because a slight change in the rate can cause considerable variations in the resulting value estimate. In an ideal situation, cap rates should be customized for each asset based on the type of property being evaluated as well as incorporating current data from a dynamic market environment. Therefore the most effective way to value CRE collateral is on a property by property basis much like deriving the WACC of individual companies. Each property is uniquely composed of different debt and equity compositions as well as the costs of each source of capital.

Target Objective

In this project I attempted to assess an objective estimate of the individual WACC for a property rather than use a generic cap rate for the property. I attempted to take subjectivity out of the equation and rely on a more objective method in deriving an estimated cap rate. The current appraisal valuations are very subjective and based on static data collected by national surveys and do not take into account the ever fluctuating variables in a real-time environment. Nor does it effectively customize the cap rate to account for the unique property type risks or the unique debt to equity compositions for each specific asset.

The Value Proposition

Please be advised that this model is not meant to replace established procedures currently in place including proper due diligence by real estate investors as well as the third party appraisal process. This is to simply provide an additional tool for investors. When used properly this can be a very valuable tool for investors to quickly, objectively, and accurately value a property. It can also be used as a point of comparison to appraisal valuations. The convenience and the ease of use allow the investor to incorporate up-to-date information that becomes increasingly relevant in a volatile market environment. In addition, the investor can run different scenarios on the property in order to estimate the value of the property based on different capital structures and quickly gauge the value of a real estate asset based on changing market variables.

Methodology

I seek to use the public markets as a clearing mechanism. I assume that the size and the liquidity of the U.S financial markets make it the most efficient allocators of capital and the most effective arbiters of risk. With millions of institutional and individual investors with monetary stakes invested in the markets their collective decisions become the most effective source at evaluating the risk of different CRE companies and different property type risks. This risk is reflected in the public markets via the Beta of each company. I used the Bloomberg REIT Index which is composed of one hundred and eleven different REIT companies. All REITs in the index directly own and manage commercial real estate properties. The index excluded mortgage REITs and indirect CRE operators. Then I further grouped all the REIT companies by specific property types. I used the collective equal-weighted average Beta of the subsectors (grouped property types) to derive an estimate of the inherent risk or volatility for each specific property type. The Beta value for each company was determined by comparing the weekly price movements of the specific company relative to a representative property index over two years in order to smooth out anomalies. By using the collective intelligence of the public markets we can efficiently gauge the volatility and the unique risk of each property type. In addition, I used the current 10 year Treasury bond to determine the current benchmark rates. The Bond market has proven to be the most accurate indicator for gauging changes in future interest rates. Historically, Bond Investors have tended to be very astute at predicting future macro-economic trends, and will automatically re-price external risks such as inflation, deflation, dollar value, and interest rates into the current bond yield. Therefore the impact of macroeconomic trends will be reflected in the current 10 Year Treasury Yield. This becomes even more important going forward as we are most likely entering into a secular long term rise in interest rates. However, please note that with continue Fed quantitative easing measures the 10 Year Treasury Yield may not accurately reflect actual real rates. With continue monetary policy manipulations likely, investors may decide to use a different benchmark such as the Triple A corporate bond rather than the 10 Year Treasury Bond for current yield determination. In any case, a customized cap rate becomes even more relevant in an extremely fluid market environment because it will incorporate real-time market data. The most difficult obstacle I encountered was how to incorporate location specific risk into the model? I could not find an objective way to implement location risk into my model. I sought to find NYC CRE indices but found no reliable realtime NYC CRE indices that could drill down to specific locations in the NYC Metro region. Although I have attempted to make the process objective there are exceptions to the rule and in such situations; qualitative analysis would be required. Therefore in this situation I incorporated a location risk premium derived based on the expert opinion of the real estate investor.

The End Game

It is critical to value commercial real estate on a property by property basis. This model will allow the user to derive an estimated customize cap rate that reflects the unique equity to debt composition, the Borrowers specific cost of debt for this property, and the alternative opportunity cost of equity investments. In addition, the customized cap rate will incorporate the current interest rates in the marketplace, and reflect the inherent risks from different property types. This extensive customization of the sub-components in a cap rate as well as the property type risks are currently not reflected in current appraisal cap rates. For a free copy of the Oxstones customized cap rate model for CRE Collateral Valuation please check out our ‘TOOLS’ section and you can download the worksheet for your own use.

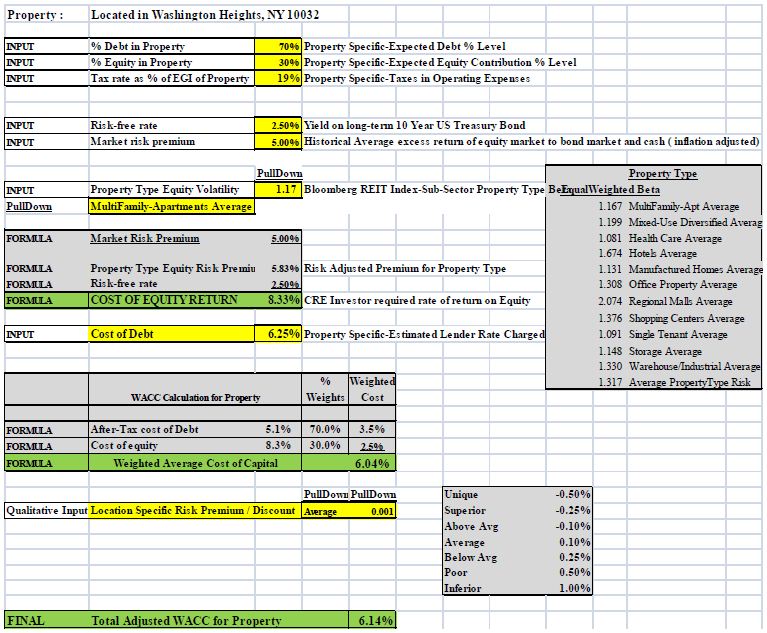

EXAMPLE – A Multifamily Property in Washington Heights, NY 10032

I tested my cap rate model on a deal I was underwriting. The following is an example of the inputs and the variables in my cap rate model. (Please see the model template for further details). The following customized data for this specific multifamily property located in Washington Heights, NY 10032 was manually inputted into my model. In this specific scenario we seek to underwrite the Debt % in this property to 70% LTV. Therefore expected %equity contribution is 30%. The tax rate for this property was derived as the taxes paid as a % of EGI for the property. The risk-free rate was derived from the current yield on the 10 Year US Treasury bond. The market risk premium is roughly 5%. This is the historic average inflation-adjusted excess return an investor would require from investing in the equity markets rather than in the risk-free US government bond market or cash equivalents. The cost of debt is the estimated lender rate banks would charge on this deal. The property type risk premium was derived from using the aggregate sub-sector property type Beta (assume equal weighting for each individual company) within the Bloomberg publicly traded REIT index. The final cost of debt incorporated the tax benefits of debt capital. The final cost of equity was derived using the CAPM Model which takes into account the risk-free market rate, the required excess return or market risk premium, and the risk adjusted premium required for different property type risks. Lastly, I used a qualitative method to determine a location specific risk premium /discount to arrive at a final customized cap rate.

Oxstones Investment Club™

Oxstones Investment Club™